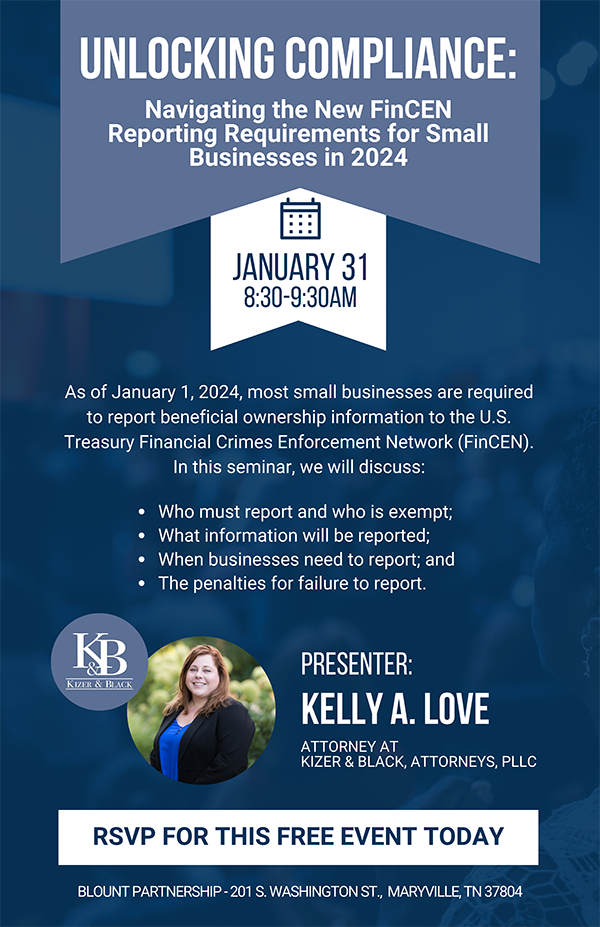

Navigating the New FinCEN Reporting Requirements for Small Businesses in 2024

Wednesday, January 31, 2024 (8:30 AM - 9:30 AM) (EST)

Description

Starting January 1, 2024, your business will likely be required to report beneficial ownership information to the U.S. Treasury Financial Crimes Enforcement Network (FinCEN). There are time limits on this reporting and significant civil and criminal penalties for failure to report. At this seminar, we will discuss what FinCEN reporting is, what information you will be required to report, and when the information needs to be reported. We will also discuss the limited exemptions to this reporting, but the reality is that most small businesses are not exempt and will be required to report.

Pricing

No cost. All members and non-members are welcome to attend.

Blount Partnership

201 S. Washington St

Maryville, TN 37804

201 S. Washington St

Maryville, TN 37804

Blount Partnership - Large Boardroom

Wednesday, January 31, 2024 (8:30 AM - 9:30 AM)

(EST)

Powered By GrowthZone